Recovery has been tracked on a nationwide scale as well. The six major metro areas have averaged a price recovery of 90% of peak compared to non-major metro areas averaging a 75% recovery. Of these six major metro areas, two have met previous peak-price levels, compared to just three among the remaining non-major metros nationwide, including Dallas, Houston, and Austin. Increased purchasing activity was also recorded across all property types in the U.S. as of August, with a recent influx of institutional and private buyers for retail properties causing prices to rise faster for the retail sector than others. Conversely, the multifamily sector has experienced a slowing of price gains after consistently leading the other sectors, potentially due to the slowing of the recent rush to rent by those hit in the housing downfall. Sales of significant commercial property nationwide totaled $24 billion in August, up 12% year-over-year.

Tag Archives: 2

Q2 2013 – NAI Industrial Market Report

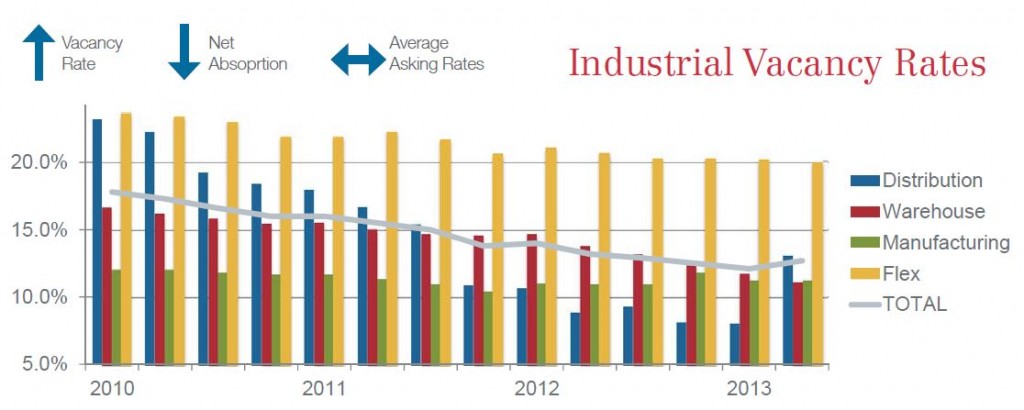

The local industrial market has served as a model of what recovery can look like, even in hard hit metropolitans like Phoenix whose housing market was crushed. Over the past several years, this sector has regained momentum posting positive absorption consistently for the past 3 years while vacancy has declined steadily from the high of 17% seen at the beginning of 2010. Tremendous strides have been made in the industrial market, but not without minor hiccups. This quarter, leasing activity fell to levels seen at the beginning of 2009, and the steady decline in vacancy rates stalled due to a large amount of vacant delivered space. Even with the slowing of pace so far this year, the sector can be expected to improve in the second half of the year as the local economy continues to ramp up.

(FOR MORE DOWNLOAD THE ENTIRE MARKET REPORT BELOW)

Q2 2013 – NAI Office Market Report

While the office sector has seen a normalizing of pace from the upswing during 2012, the Phoenix Metropolitan area continues to boast a steady employment market even during the recovery. This bodes well for the sector as office related employment continues to grow. In May, finance related employment in Arizona added 1,300 jobs, well over the average gain of 200 jobs for May for the last 10 years. Professional and business services also saw a significant increase, adding 1,200 jobs and ending five consecutive years of job losses in May. This gain was considerable in comparison to the post-recession average loss of 2,200 jobs during the same month. As 2013 progresses, conditions can expect to improve as the market picks up from the lull of the first half.

Vacancy rates continued to fall overall coming in at 20.5% for the second quarter of 2013. While only slightly down from Q1 2013, Q1 2012 posted an overall vacancy rate of 22.5%. Class A space has seen the most significant realignment as the market recovers; at the beginning of 2010, vacancy rates for Class A space sat at 26.4% and have now fallen to 19.7%. In contrast, Class C space has seen the opposite as better space becomes more affordable and the amount of Class C space that needs to be demolished and removed from the market increases. At the beginning of 2010, Class C office space had a vacancy rate of 14.9%, while the current rate is 17.8%. The gaping disparities between vacancies in each class will continue to come to settling point as they clearly have over the last three years. As the market rebounds fully we can hope to see aged properties removed from the market and give a truer sense of actual vacancies.

Absorption numbers continue to remain positive albeit low compared to the second half of 2012; year to date net absorption totals just below 150,000 SF, while the first half of 2012 came in just over 1.1 million SF. While this slowdown has failed to significantly impact vacancy rates, it does mark the eighth straight quarter of positive absorption in the Valley. Again this quarter, Class A space is the standout; 204,610 SF was absorbed in Class A space this quarter, balancing out the negative net absorption for both Class B and Class C. Class C continued to see negative net absorption with -78,462 SF of space absorbed, marking the sixth straight quarter of negative absorption for the lower grade property sector. Not only are tenants leaving properties in search of better space for their dollar, but these numbers increase the pressure on low quality space to be redeveloped in order to remain competitive within the current market.

Rental rates increased slightly this quarter, inching to $20.21 PSF from $19.63 the previous quarter. Class C space posted an average rental rate of $14.73 PSF, up slightly from $14.57 PSF a year ago. Class B properties saw a decent increase from last quarter with an average rental rate of $19.31 PSF, up almost a dollar from first quarter this year. Class A also saw a slight increase this quarter at $23.21 PSF, but continue to remain within a $0.10 difference from rates last year.

So far, 2013 has shown positive signs for the office sector in regaining a predictable future; absorption continues to remain positive, vacancy rates continue to decline and stabilize, and while rental rates have not seen dramatic improvement, the consistency builds hope for steady increases. The office sector can expect to remain steady this year in anticipation for a positive boost in 2014.